SoFi Technology, revolutionizing the banking industry

SoFi: The next 100 Billion dollar company in the making?!

SoFi was founded in 2011, by Stanford business school students originally under the name Social Finance, Inc. Originally using an alumni-funded lending model to connect recent grads with alumni in their community. This led to their expanding of their student loans, launching a nationwide student loan refinancing program in 2012, with the goal to help students to finance their education with better interest rates. After a couple of years SoFi expanded its portfolio by introducing personal loans, allowing members to consolidate debt, finance major purchases, or cover unexpected expenses. Since 2016, SoFi transformed from a student loan refinancing company into a full-service financial platform. It launched SoFi at Work in 2016, introduced refinancing for medical residents in 2017, and expanded into mortgages in 2018, the year of the appointment of current CEO Anthony Noto. After that, the company added SoFi Money and SoFi Invest, followed by the Galileo acquisition and the reaching of 1 million members in 2020. SoFi went public in 2021 and became a national bank in 2022. By 2024, it now surpassed 10 million members.

I think SoFi has done a remarkable job for now and has positioned itself very well for the next decade. Sofis management sees a huge opportunity in revolutionising the banking system. The banking industry is huge, just to give you some numbers, Grand View Research expects the US retail banking market to grow at a CAGR of 4.5% from 2023-2030 to a staggering market size of USD 2,840.70 billion. SoFi doesn't have to be the market leader, just a friction of the whole industry could make SoFi a $100 billion company in the future.

This growth is largely driven by technological advances. The rise of online and mobile banking has made banking services more accessible to customers and banking can become really easy, at least compared to the past. This is exactly what SOFI is doing and where its huge potential lies. If you think about a lot of customers of the more traditional banks, they don't know about most of the things that go on behind the curtains and they don't want to know, nobody wants to go to the bank and talk to their banker about their money. Now where SOFI comes into play is that they make banking easy and accessible, giving consumers a much simpler solution where they just open their app on their phone and have everything they need.

SoFi wants to have a solution for everything related to banking (borrowing, saving, spending, investing and protecting your finances). Below you can see SoFi's "Members' One-Stop Shop", basically their ecosystem of products offered.

SoFi, like many others, is interested in creating an ecosystem where they customers do everything related to their banking in one app, thus giving customers the option to take a loan or buy shares of a company separated in a few clicks.On the chart you can see the more traditional lending offerings, this is the way SoFi started with and usually the first point of contact of children with SoFi. Nevertheless, SoFi's focus is shifting more and more towards financial services, as this is where the high margins lurk.nLet's take a quick look at SoFi's main offerings before we dive deeper into the company.

1. Lending Products

Personal Loans: For debt consolidation, home improvement, family planning, travel, etc.

Student Loans: Includes student loan refinancing and in-school lending.

Home Loans: Covers agency and non-agency loans, including VA and FHA loans for home purchasing or refinancing.

Loan Servicing: SOFI retains servicing rights for many loans, generating ongoing revenue through servicing fees.

2. Financial Services

SoFi Money: A digital banking platform offering checking and savings accounts with competitive interest rates and expanded FDIC insurance. SoFi Money is their most successful financial product. It helped drive nearly a 9x increase in revenue per product for Financial Services overall.

SoFi Credit Card: Offers cash back rewards with no annual fees.

SoFi Invest: A mobile-first investment platform offering active investing, robo-advisory services, and access to various financial products like stocks, ETFs, and alternative funds. SoFi itself believes that Invest will follow SoFi Money path and become the next super successful financial product, therefore SoFi plans to allocate a lot of resources in the product

SoFi Relay: A personal finance management tool that helps users track accounts and gain insights into their financial habits.

SoFi Protect: An insurance product offering coverage through third-party providers (auto, life, home, etc.).

SoFi Travel: Provides travel booking services with added benefits for SoFi members.

SoFi At Work: A program to offer financial benefits to employees of partnered enterprises.

3. Technology Platform

Galileo: A technology platform that powers financial services for both financial and non-financial institutions.

Technisys: A cloud-native banking platform that offers core banking services, enhancing SoFi’s capabilities in the financial technology space.

4. Banking Services

SoFi Bank: Offers checking, savings, and credit card services. It also enables lower funding costs for loans by utilizing customer deposits.

SoFi's focus is on member growth, which has slowed over the last few years, but the total number of members has increased tenfold in the last six years alone. SoFi is trying to attract as many members as possible at the moment, so it's no surprise that they're putting a lot of focus on marketing, which we'll talk about a little bit later. I think there's still plenty of room to grow for SoFi members wise and when it eventually slows down they'll have attracted enough members to change there approach a bit and focus more on creating and improving there products while increasing there annualised revenue per product.

That's why product innovation is one of the most important things, you have to keep coming up with new products to give the customer a reason to join the ecosystem, but more importantly to keep your old customers, if you've already acquired them then it's much cheaper for SOFI to bring them into their latest products. A high retention rate is important, and SOFI succeeds in this, making every customer, old or new, more valuable than they were a quarter or a year ago. That's where the circle closes, attracting new customers, innovating new products and keeping them so they don't leave.So how does SoFi attract customers? Its marketing strategy is built around brand awareness, customer acquisition and retention, using a mix of digital, influencer, sponsorship and referral marketing to grow its membership base. The first time I heard about SOFI was a few years ago when the Los Angeles Rams and Chargers unveiled their new stadium (SoFi Stadium), which has the name on a 20-year deal. They are still following a similar strategy by dipping into sports leagues, they recently unveiled a partnership with a supporting league brand in TGL, which is sort of a new tech-driven golf from Tiger Woods. I don't know much about the sport, but after searching it on Youtube it took me a second to see the SoFi sponsorship. This means that brand visibility is paramount. Sofi also uses Google Search Ads to increase their visibility. For example, users searching for "student loans" would see SoFi at the top of the search results. It also ran highly targeted Facebook and Instagram campaigns, highlighting limited-time offers on its credit card or mortgage rates. Additionally, YouTube pre-roll ads featuring SoFi's "Get Your Money Right" campaign highlight the platform's all-in-one financial services, making SoFi almost impossible to miss on any platform. SoFi is also leveraging the influencer and referral marketing space by partnering with finance-focused YouTube influencers to create sponsored content that compares SoFi's high-yield savings accounts or investment platform to competitors. Another strategy is personalised offers. If a user refinances their student loans with SoFi, they might receive a personalised offer for a SoFi credit card with an increased welcome bonus. Similarly, a SoFi Invest customer who has a cash balance in their brokerage account might receive a tailored email offering higher APY rates on SoFi Checking & Savings, encouraging them to deposit their funds within the SoFi ecosystem. So far, the strategy is working brilliantly, with a focus on efficient customer acquisition, increased engagement and long-term retention.

Financial Services and Tech Platform

Financial services and the tech platform are at the heart of SoFi and its strategic move towards a fee-based business. We can see in the graph above how much the shift to financial services and the tech platform has taken place in terms of revenue, accounting for almost 50% of SoFi's revenue. SoFi now has 2.5 million investment products, with 70% of the growth coming from existing SoFi members. The plan for SoFi there is to continue to add new members while increasing monetisation of existing members, creating two engines of growth. I think this shift will continue to expand, recently SoFi gave their guidance for financial services where they expect very strong growth in the range of 60% to 65% as a result of continued growth in product and overall monetisation. and that is not all, Anthony Noto comments on the margins are very interesting:

In terms of the margin profile, you can expect Financial Services, we're at about a 45% margin and $81 of annualized revenue per product. We're still undermonetized in Invest, so there's opportunity.

By far the most successful product is sofi money. It was previously launched as a cash management account, combining both current and savings accounts (some benefits were no account fees, fee-free ATMs or early direct deposits). However, after receiving its banking licence in 2022, SoFi rebranded the service as SoFi Checking and Savings, which is a high-yield banking service offering competitive annual percentage yields (APYs) in an effort to be competitive and offer good interest rates to its customers.Another product that was mentioned a few times in the recent earnings call is SoFi Invest. Sofi Invest, as we saw above, is a platform for investing in equities, ETFs and cryptocurrencies. They offer both active trading and automated investment solutions. With active investing, users can buy and sell shares, ETFs, investment funds and, from January 2024, money market funds. Essentially a broker in your bank account, it is a great way to get your clients involved in the market. There are other options such as options trading, margin investing and participation in IPOs, while there is also the ability to buy frictional shares, which is a must if you want your smaller or less risk-averse clients to participate in SoFi investing. SoFi also gives you the option of automated investing. This offering includes a robo-advisor portfolio of ETFs and mutual funds, managed by an investment committee with the assistance of an external asset management partner. In late 2024, SoFi expanded its investment offerings by introducing access to alternative investments, including private market funds. One notable addition is the Templum Cosmos Fund, which offers exclusive exposure to SpaceX. SoFi also launched a new robo-advisor platform in partnership with BlackRock, further expanding its automated investment capabilities.

SoFi Protect could follow a similar path, Noto called it a service where they want to grow much faster than in the past. In Q3 they signed up their first two direct insurance providers, meaning they are no longer just an intermediary. Protect offers different insurance products like life insurance, homeowners insurance, car insurance, renters insurance and cyber insurance. it's very obvious and easy to understand that with continuous monetisation and members on the platform every service (?) should benefit. if you can get your insurance or your investment broker inside your bank account, why should you then go to a third provider? That's why SoFi's approach is to partner with industry-leading companies so that they can deliver at a very high level from the outset, and sometimes just act as a marketplace where they connect members to third parties and collect referral fees (for example, in the lending space, SoFi makes loan and bank referrals for borrowers who are not currently served). All in all, it is through financial services and its technology platform that SoFi can benefit the most, as its a capital light model with fewer risks from its previous loan-only business.

SoFi's tech platform is more than critical to its future success. While many legacy players are struggling with digital transformation, SoFi (one of the fastest growing banks in the US) is gaining ground. It recently surpassed 150 million platform accounts (168 million accounts in total, up 15% year-on-year).Unlike SoFi's more traditional services, its technology platform has less volatility. It operates on a software-as-a-service (SaaS) model. This means that it provides software and banking infrastructure solutions rather than direct financial products. The technology platform consists mainly of Galileo and Technisys. Galileo operates as a separate entity, although it's also used by SoFi for its own products. It's not fully integrated yet, and also provides banking infrastructure to external customers (it's basically like AWS, which Amazon itself didn't fully integrate into its operations for years). Galileo's core function is to handle payment processing, card issuance and financial infrastructure for banks and fintechs. The main purpose of this acquisition was to expand into commercial banking, offering businesses the ability to issue debit and prepaid cards, process transactions and manage business banking services.

Examples of the use of Galileo's technology include H&R Block's Spruce, which offers free banking services and generates revenue through interest rate arbitrage. Row helps companies track B2B spend and integrate with ERP systems. CLA's Earned Wage Access platform allows gig workers to access their wages before payday with fee-free transfers. M Banq uses Galileo's API-based banking services for card issuance and digital banking. This allows these companies to integrate a technology solution that looks like a bank without having to build it themselves. Traditional banks also rely on Galileo for faster time to market, lower costs and proven expertise. Smaller and regional banks that do not have the resources to build their own digital banking solutions can instead white-label Galileo's technology. This modularity allows customers to choose only the services they need, be it credit card issuing or payment processing, and Galileo's CPO David Feuer sees these customised solutions as a major opportunity for SoFi in the future:

Core to SoFi’s digital banking, payments, and financial services, Galileo's technology drives seamless, integrated experiences that redefine what’s possible in fintech. By leveraging Galileo’s robust API-driven infrastructure, clients can build tailored solutions that adapt to specific business needs and customer expectations, empowering SoFi and other fintech leaders to engage users in powerful new ways.

SoFi's acquisition of Technisys in 2022 marked a significant step towards vertical integration of its banking technology infrastructure, following its earlier acquisition of Galileo. While Galileo facilitates payment processing and card issuance, Technisys provides the essential banking framework that manages deposits, loans and customer accounts. The synergy between these two entities will result in a comprehensive platform that will enable SoFi to manage its entire financial ecosystem, enhance product innovation, and reduce dependence on external providers (synergy impact expected in 2026).Technisys' cloud-native banking platform, Cyberbank Core, supports real-time processing, tailored banking experiences, and multi-product capabilities. Unlike traditional core systems, it enables SoFi to scale effectively, accelerate new product launches and reduce costs, with expected savings of $75-85 million by 2025. In addition, Technisys is facilitating SoFi's move into commercial banking and banking-as-a-service (BaaS), enabling corporate clients and fintech companies to offer their own financial products through SoFi's infrastructure.

This acquisition positions SoFi as both a consumer bank and a technology provider. The integration of Galileo and Technisys enhances SoFi's competitive advantage, transforming it into a more efficient, innovative and scalable financial institution, while opening up new revenue opportunities through B2B services.

For the tech platform, SoFi expects low double-digit growth into the teens in 2025, with medium-term margins in the 30% range. This is before the aforementioned synergies in the tech platform, which leads me to believe that SoFi will grow even more in this segment.

SoFi's fee-based business model continues to show impressive growth, particularly in areas such as interchange, brokerage and its new SoFi Plus offering. The company saw a remarkable 63% increase in interchange revenue this quarter, demonstrating strong momentum in this segment. In addition, SoFi is improving its monetisation efforts in the brokerage business with SoFi Invest, further increasing its revenue streams. Its technology platform is also a significant contributor to fee income, with the company's diversified approach generating a growing share of fee-based revenue. In total, SoFi's fee-based revenues reached $970 million for the year, an increase of 74%. This growth is driven by origination fees, lending platform transactions, referrals, interchange fees and brokerage activity. The company operates a cash-upfront model for its loan platform business, which differs from gain-on-sale accounting.

We can see in the chart above that the ratio of financial services to credit products is moving more and more in the direction of financial services, which is intentional, currently at 6.3, up from 3.8 three years ago. And we can also see why, some financial products are growing much faster, with money and remittances leading the way, but the credit segment is also growing, with personal and home loans showing growth of over 20%. Nevertheless, financial services products accounted for over 89% of our total product growth, which means that the credit segment is maturing and moving to the more profitable financial services. They are diversifying more and moving to a capital-light model, which is based on a fee-based model, as we said earlier, so it's no wonder that Sofi reached a record $970 million for the year, up 74% on the previous year. Revenue per product in Financial Services also reached a record high, increasing from $59 in Q4 '23 to $81 in Q4 '24. The Financial Services segment is also far from mature, with many products still in their early months/years. The focus is also not on launching as many products as possible, but rather on having a long-term view and launching a finished and polished product that can help sofi achieve its long-term goals.

CEO Anthony Noto on SoFis recent developments and there impact in 2026:

First, we recently were selected by the U.S. Department of Treasury for Direct Express, a prepaid debit card program that approximately 3.4 million people use to access their federal benefits.

Second, we just signed a large U.S. based financial services provider that offers short-term consumer loans, card services, check cashing and other financial products. They've built a large, loyal and highly active debit card portfolio over the past two decades and will now rely on our technology to power existing and new capabilities. Once they fully transition to our platform in early 2026, they will be a top 10 client on a revenue basis.

Third, we've signed a partnership with a leading hotel rewards brand for a co-branded debit card program launching in the first half of '25. This is a new differentiated offering that will expand our footprint among consumer brands.

SoFi believes it is well positioned in terms of brand awareness and overall reputation. It claims to be the only one-stop digital shop in the U.S. SoFi regularly revises its product offerings to increase member value. One of its most popular offerings is SoFi Plus, which was initially only available to members who enrolled in direct deposit. Now, for a $10 monthly fee, members can access the benefits of SoFi Plus, unlocking perks such as SoFi's highest APY, a 1% match on recurring Invest deposits, extra cash back on SoFi Travel, interest rate discounts, credit card cash back, and more. According to SoFi, SoFi Plus members receive an estimated $1,000 in annual value, and additional features include free person-to-person payments using just a phone number or email, bill pay, no-fee overdraft protection, and up to two days of early access to paychecks. Importantly, the value of SoFi Plus is expected to grow over time as SoFi's costs decrease and more can be invested in developing new products and features, ultimately increasing the benefits for members.

Lending Platform

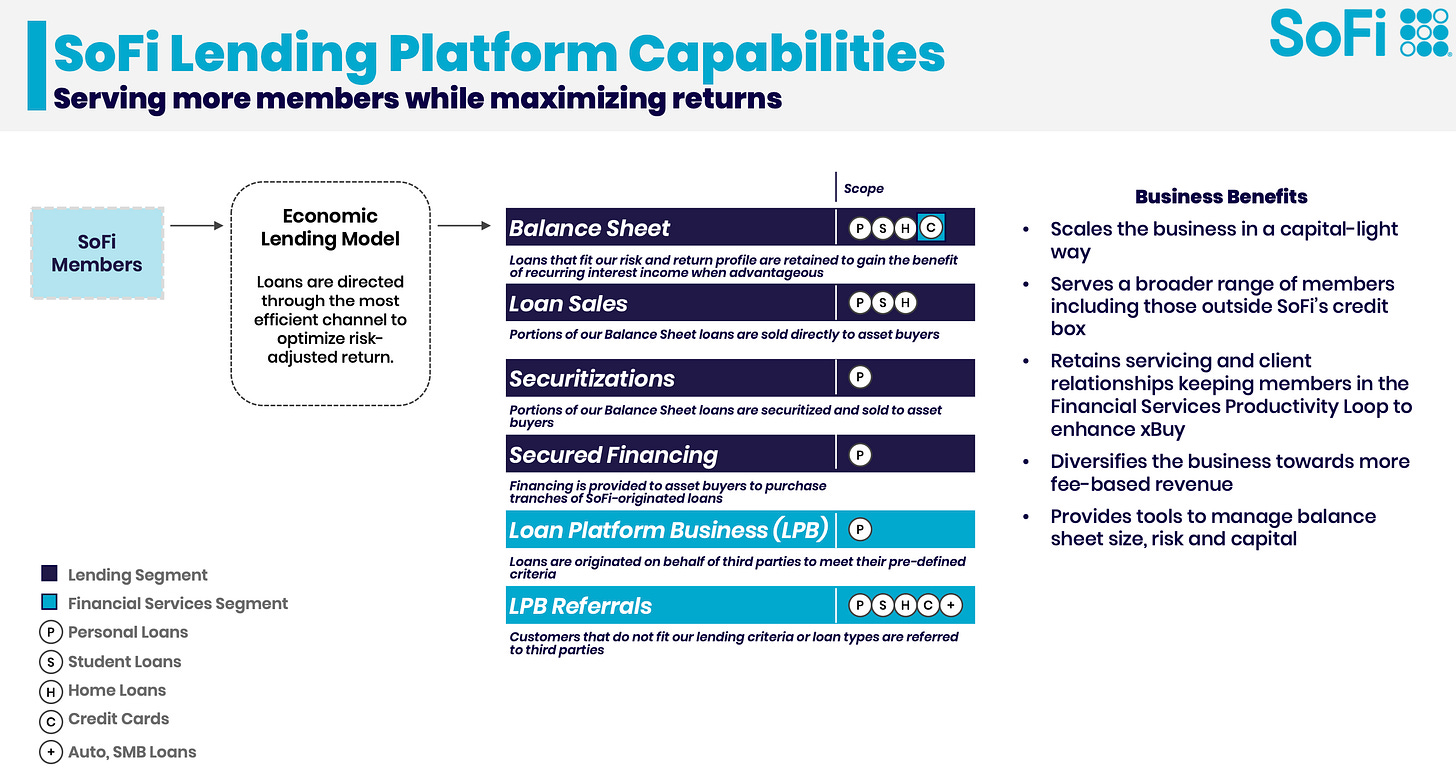

SoFi's lending platform used to work in one of two ways. Either the customers who wanted a loan went to SoFi and applied for a loan, which SoFi then had on its balance sheet and earned net interest from. The other way would be for SoFi to make the loan but immediately sell it to a third party so as not to keep it on its balance sheet. Now the lending platform has evolved to the point where the CEO himself said: "This model is a game changer. Since 2024, SoFi has been running the loan purchase program, well, it works in a way that SoFi works with companies like Fortress to make pre-defined loans, with which they designed a $2 billion deal last quarter, to expand their relationship with Fortress even further, they also agreed terms for a $5 billion two-year deal with Blue Owl Capital Funds, as well as having commitments for the rest of 2025 with other partners, including top investment banks as well as private equity funds. SoFi is basically the trading platform of basically like Amazon, only for loans. And I agree with the CEO that this is a game changer because it's the best business model you could ask for, people are already using your platform, so when they try to get a loan, SoFi gets the fees and doesn't hold any risk. This is where SoFi can really increase margins in the future by moving more and more into a capital light business. In addition, SoFi retains the servicing rights, which means they continue to generate recurring revenue from managing the loans, even though they no longer carry the credit risk. The image below shows how SoFi operates its lending segment to minimise risk and maximise value.

For 2025, SoFi still expects revenue growth for their lending business to be in the low double digits to teens as demand for boring in both personal and student loans sees strong demand, while also being able to accept more loans in general through their ability to sell immediately to third parties or serve as an intermediary platform. Their medium-term guidance from 2023 to 2026 is to grow in the mid-teens, in which they are also on track to achieve this.I get a very confident feeling from management in the lending segment, also the scaling of their lending business platform is starting to generate margins at around 50%, slightly north of that (lending segment should remain in the mid-50s to mid-60s range going forward).

In another chart presented by SoFi, we can also see how the newer vintages look in terms of credit performance. The newer loan vintages (Q4 2022 - Q1 2024) show better credit performance than the older vintages (2017), with lower losses at the same level of unpaid principal balance (UPB). Better credit performance means lower risk for SoFi. Lower defaults can also be positive for SoFi's balance sheet and profitability. Credit trends continue to improve, with delinquencies peaking in Q1 2024.

SoFi has shown very solid revenue growth in recent years, while reaching profitability in 2024. Adjusted net revenues were $2.6 billion, up 26% year-on-year. The Financial Services and Technology Platform segments together generated revenues of $1.2 billion, up 54% year-on-year. These two segments alone accounted for 47% of SoFis adjusted net revenue, up from 38% last year. As a result, we see improved adjusted EBIDTA and net income margins. In particular, net income margins will improve to over 20% in the next few years. I don't see why SoFi shouldn't get a multiple expansion in the near future.

With the way SoFi handles guidance I wouldn't be surprised if the CEO raises their own guidance again this year. over the last few years they have deliberately low balled there guidance so I see a good chance it could happen again in the future.

Looking ahead to 2025, the company has strengthened its capital base, achieved GAAP profitability, and reached the necessary scale to sustain long-term profitability.,The company aims to strategically shift its incremental revenue growth towards reinvestment, as it has consistently shown that increased investment drives durable growth and strong returns.,In 2025, the company plans to manage toward an incremental EBITDA margin of approximately 30% and target a year of 25% durable growth, aligning with its broader goal of maximizing long-term shareholder value.,For the full year 2025, the company expects to add at least 2.8 million members, reflecting year-over-year growth of at least 28%.,Adjusted net revenue is projected to range from $3.20 billion to $3.275 billion, representing 23% to 26% year-over-year growth.,Adjusted EBITDA is expected to fall between $845 million and $865 million, in line with the targeted 30% incremental EBITDA margin.,Adjusted GAAP net income is forecasted at $285 million to $305 million, reflecting a 20% incremental margin when excluding the $63 million one-time gain recognized in 2024 from the partial conversion of 2026 convertible notes.,Adjusted GAAP earnings per share are anticipated to be in the range of $0.25 to $0.27.,Beyond 2025, the company expects to exceed its previously communicated medium-term target of 20% to 25% compounded annual revenue growth through 2026.,The company remains confident in achieving 2026 EPS in the range of $0.55 to $0.80 and delivering 20% to 25% annual EPS growth beyond that.,The company is also making strong progress toward its long-term goal of funding 85% to 90% of its loans through customer deposits, reducing reliance on external funding and improving margins.,This is enabled by SoFi Money, which allows the company to efficiently deploy member deposits to support its lending activities.,Furthermore, the company has demonstrated the ability to prioritize margin over near-term revenue growth, while still growing the top-line by 30%.,The company remains highly confident in its long-term margin outlook and has a clear strategy: continue prioritizing revenue growth as long as strong opportunities persist, and shift focus toward margin expansion once top-line growth begins to normalize.

Valuation

Valuation wise, SoFis stock really came down the last few weeks due to the tariffs and fear of recession, if we were to get into a recession I believe sofis stock price would suffer a lot more. now its trading at 36 times forward earnings. after trading at less than $10 per share at the moment. below we can see Wall Street estimates

However, im still confident in their CEO and the company in the medium and long term future. they low ball their guidance and still give out very good numbers if they weren't overachieving. Lets say they hit their target of EPS in the range of 0.55 and 0.8 in 2026, as well as 20-25% EPS growth beyond that. With that in mind, I think a PE of 30 is very conservative (assuming they hit their targets and achieve a 20% net profit margin).

This would mean that on the low end they would achieve 0.8 eps in 2028, which would give them a share price of 23.7, or an IRR of 34.41%. On the high end they would achieve an eps of 1.56 in 2028, which would give them a share price of 46.9, or an IRR of 68.7%.

However, one should not forget about the share based compensation which is still at a high level and the stock has not taken a beating for nothing recently, so I wouldn't go all in on this stock as it is not recession proof.

Overall, SoFi is a high quality company and I believe they will show remarkable results with potentially huge investment potential.

If you enjoy research like this, don’t forget to like and subscribe! Also, sharing this post on social media or with colleagues - along with a positive comment, helps the publication grow. Every share is greatly appreciated!

This was a monster breakdown — I genuinely appreciate the level of depth and nuance here. Especially liked how you framed SoFi’s dual flywheel: onboarding new users while deepening monetization per member. That kind of strategy reminds me of what Amazon did with Prime — once they got users in the door, they kept stacking value.

The part about Galileo and Technisys was 🔑 — I hadn’t realized how close they were to becoming a vertical banking infrastructure beast. It’s like they’re quietly building the AWS of fintech while most analysts still treat them like a student loan company. And your call-out of the “capital-light lending marketplace” play is spot on. That’s what makes this feel like a different animal than traditional banks.

One thing I’m tracking: how well they manage stock-based comp and if they hit that 25% EPS CAGR beyond 2026. If they do, the rerating could be aggressive — but the market’s punishing any fintech with too much SBC or macro sensitivity. Still, as a long-term hold, I agree — the optionality here is huge.