Growth Stocks Series 1: Wingstop

Can AI Turn Them into a Top 10 Global Restaurant Brand?

How it started

The restaurant chain was founded in 1994 in Garland, Texas by Antonio Swan. After just three years they began offering their first franchised store in 1997. By 2002 Wingstop stated that they were already serving up to 2 million wings. Notable events in their history include opening for lunch, introducing their first-ever boneless wings, and establishing their first international location in Mexico in 2010. As of 2025, Wingstop has over 2500 restaurants in 12 countries.

Business model

Wingstop is primarily a franchisor, which means they don't operate their stores by themselves but have their restaurants owned and operated by independent franchises (approximately 98%). Wingstop relies on an asset-light business model, which, due to the high number of franchise stores, generates a higher operating margin than other restaurant chains and requires hardly any capital expenditures. Wingstop mainly sells chicken wings (both bone-in and boneless), along with crispy tenders, chicken sandwiches, and various sides like fries, corn, and veggie sticks, while also having a big focus on daily in-house made sauces, to round up their flavor. Wingstop also has the mission to offer every flavor you want, they have 12 different flavor offers along with limited time offerings for special flavors, they pair this with their offering of numerous order options like dine-in / carryout / delivery; individual / combo meals / family packs, that allows Wingstop customers to enjoy their food under all circumstances, doesn't matter if it's the family meal in the rush hour or the quick meal late at evening. With those offerings, Wingstop tries to create a unique customer experience that makes a visit memorable not only for the food, but also boosts brand loyalty.

Their overall goal is to become a Top 10 Global Restaurant Brand. They give themselves a runway of 6,000 restaurants in the US and 4,000 restaurants internationally, which is a big raise from 2022 when they gave out a global restaurant potential of 7,000 restaurants. Wingstop proclaims itself in the flavor business and not in the wing business. With a simple mission and vision: serve the world flavor and to become a Top 10 Global Restaurant Brand.

How do they want to achieve that? Sustain Same-Store Sales (SSS) growth by expanding recognition of the Wingstop brand to a broader audience, utilize data to enhance marketing efforts and customer targeting, and invest in digital tools and technologies to streamline operations and improve customer experience. The CEO Michael Skipworth called Wingstop the largest brand no one has heard of, while stating that their ad fund budget is continually growing.

The second pillar is maintaining best-in-class returns by finding ways to reduce costs and maintain healthy margins, constantly offering new and innovative menu items to keep customers engaged, and adjusting operational models and strategies to ensure optimal performance. The last pillar is accelerating growth by implementing a well-structured plan to guide expansion efforts, focusing on expanding Wingstop’s presence internationally, and using the company’s financial position to support growth and expansion initiatives.

Best-in-Class Franchise?

Wingstop believes, through their success, growing popularity, and the simplicity of operating their restaurants, it makes them a prime destination for people wanting to open a franchise restaurant. Existing franchisees accounted for more than 90% of franchised restaurants opened in each of 2023 and 2024. This number reflects the financial appeal of their franchise model. If you want to start a franchise, the initial investment is around 535,000$ (excluding real estate purchase or lease costs and pre-opening expenses). Wingstop aims for a cash-on-cash return of approximately 70%+ in year two of operating the business.

The high potential for good returns for franchisees makes Wingstop an attractive choice. Another thing where Wingstop sees big potential is the growth of their domestic average unit volume (AUV stands for Average Unit Volume and refers to the average revenue each individual restaurant generates over a certain period). The target of 2 million, which was set in 2022 on their investor day, was achieved this year when Wingstop reached 2.1 million of AUV per restaurant. Therefore, the target was raised to 3 million in their latest earnings call.

And this is not all, we’ll now look at another point that could exceed even this new target in the future.

Digital presence edge

Wingstop proclaims itself as a tech company serving flavor. Their CEO said of the importance of technology to them:

Technology has always been at the forefront for us at Wingstop, and 2024 was a transformational year for our digital business. We launched our proprietary tech stack, MyWingstop, in 2024, which we believe will further advance our best-in-class digital platform. Our digital database has surpassed 50 million customers, nearly 30% growth versus the prior year, which is truly remarkable.

The most pronounced impacts we have seen early into our launch center around new guest acquisition with a record pace of registrations, increased frequency, and improved ROIs on our hyper-personalization strategies. Guests are beginning to experience a new level of hyper-personalization, enabled by the data gathered from our platform, providing them with relevant, personalized, and optimized content.

Over the past two quarters, we have seen an increase in the number of guests opting in for notifications and registering with our platform. This information will help us to fine-tune our robust profiles to engage with our guests in a way that personally resonates with them, creating a more meaningful and engaging experience, which we feel is a competitive advantage for Wingstop.

And while many of our investments in the past have been focused on more of our consumer-facing digital platform, we also have been innovating around technology that can optimize the back of the house in the restaurant. A little over two years ago, we started working on a solution that we believe will unlock unmet demand.

We also talked about the raising of AUV and the recently raised target of 3 million per restaurant. In the past, it was mainly driven by transactions. Now, the company is set for a new phase where most of the growth should be a result of improving operating processes. Longer lead times often lead to curbing demand during peak hours. Now, Wingstop has developed a proprietary AI-enabled kitchen platform that allows them to speed up service and provide a more consistent guest experience. As a result, Wingstop aims not only to handle peak hours more effectively but also to relieve staff, allowing them to perform other tasks more efficiently. The new kitchen platform has already shown success, leading some restaurants to an AUV of over 4 million.

Big Opportunity to Grow Internationally

As of December 2024, Wingstop has 359 restaurants internationally, so according to their own estimates, there is room for an expansion of more than 3,500 restaurants, of which 71 opened in 2024. Wingstop believes that there is not only a significant opportunity in existing and new domestic markets but explicitly in international markets. Also, the previously mentioned franchise model is designed to make it easier for future franchisees, making the decision to open a Wingstop franchise easier.

To achieve that, Wingstop tries to build a global brand. It is essential to offer a consistent core flavor experience, while also tailoring some menu options to local tastes to give the flavors a more personalized touch. Therefore, it is important to create the necessary infrastructure to support and expand global supply chains. Additionally, a global digital presence is necessary to achieve the required visibility.

Taste

But the most important part is: how does the food taste? Allrecipes ranked Wingstop in first place in its list of the best chain restaurant wings:

The chain’s original hot sauce is labeled “the first sauce we tossed, full of heat and tang” and it’s exactly that with excellent vinegar notes. That thick, luscious sauce covers the wings perfectly—the folks at Wing Stop have mastered the toss—and it really clings to the exterior instead of running right off or forcing the chicken to wallow in soup. The outside was firm, allowing a substantial bite and the inside was juicy and cooked nicely. Once that wing craving gets too big to manage, I recommend popping in to a Wing Stop to feed it.

Personally speaking, I only tried Wingstop once, and it was not in the US, but in London. My experience was in a packed restaurant, which I’m personally not the biggest fan of, and I would have rather gone to my hotel room to eat in peace but anyway, I really enjoyed the wings and the focus on different flavors, which made the experience more exciting. Prices were okay, and I would definitely visit again sometime.

Risks

Growth is very important for Wingstop, therefore they rely heavily on the opening of new franchise locations. With that, they need to find suitable locations (permits, training staff, labor costs), and even if restaurants open, they might not perform as expected. These locations often require extra advertising and face stronger competition. However, they still need to achieve the company’s high target of a 3 million AUV in the future.

This risk is particularly true for international markets, where Wingstop is trying to expand a lot in the future (we talked about a minimum of 3,500 new restaurants internationally). Expanding into new countries always bears the risk of not being as successful as in the US. Brand awareness and recognition must be significantly improved in order to have a chance. On top of that, the broader fast casual dining space is fiercely competitive. The company competes not only with other chicken-focused chains but also with everything from local diners to meal kit services and grocery store delis. If the company can’t maintain its edge in quality, service, and customer experience, it risks losing traffic, revenue, and profitability.

Another risk I would definitely keep in mind is the bone-in wing inflation, which is also shown in the image below. Prices of jumbo bone-in wings doubled, partly due to COVID, from 2020 to 2021. Nevertheless, Wingstop was still able to grow its total restaurant count, but it’s definitely a headwind that should be kept in mind, as it can hurt margins significantly.

Financials and Valuation

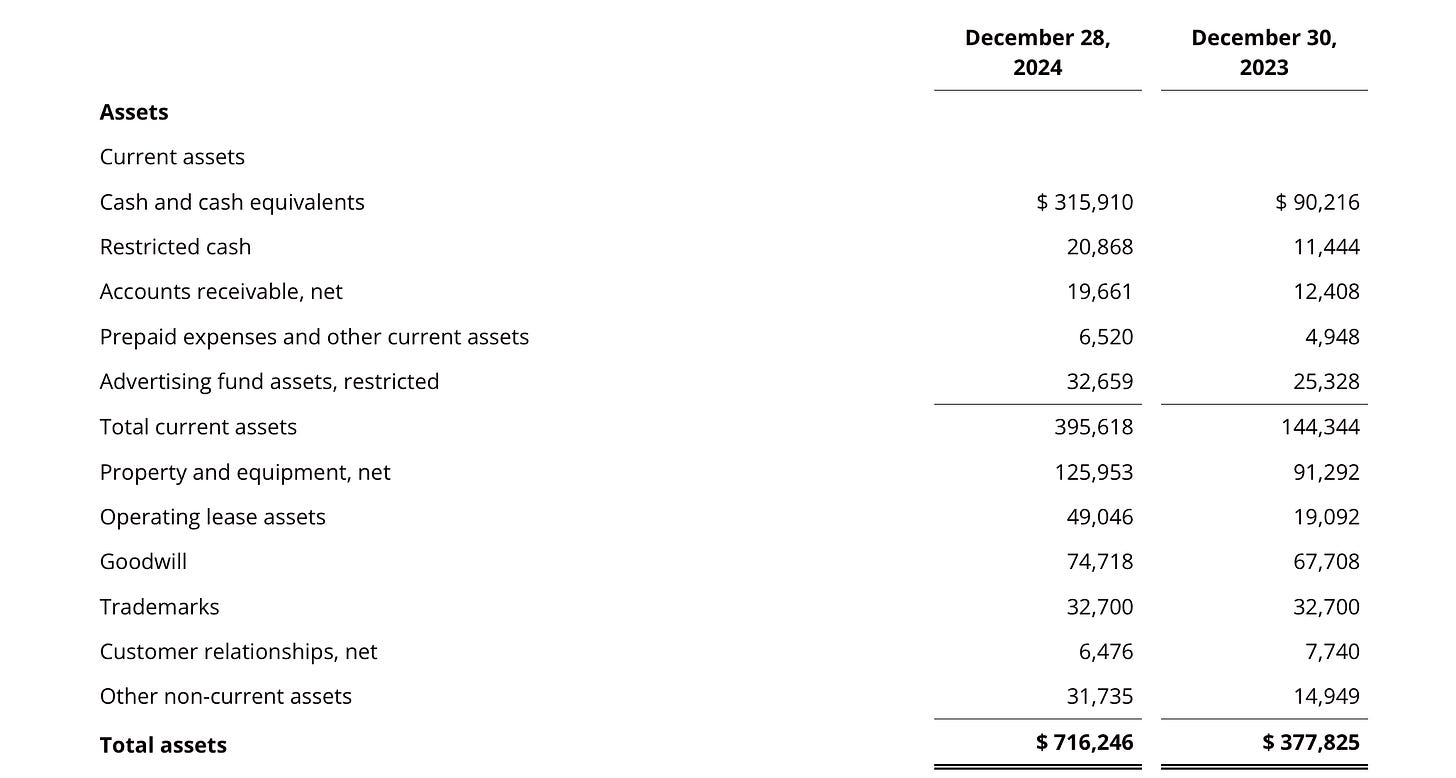

Below is a snapshot of the company’s assets from the balance sheet. Total assets almost doubled, while cash increased 3.5x.

However, Wingstop’s long-term debt also increased by a big margin, which should definitely be looked at closely, as operating income is only 166 million.

Wingstop’s key metrics are highlighted below. Total revenue increased by 36%, the highest percentage since 2018. 349 net new restaurants led to a 15.8% growth rate.

System-wide sales increased 36.8% to $4.8 billion

349 net new openings in fiscal year 2024

System-wide restaurant count increased 15.8% to 2,563 worldwide locations

Domestic same store sales increased 19.9%

Total revenue increased 36.0% to $625.8 million

Net income increased 54.9% to $108.7 million, or $3.70 per diluted share

Adjusted EBITDA, a non-GAAP measure, increased 44.8% to $212.1 million

Wall Street’s estimates are below. The business has healthy margins and should enjoy continuous growth in all areas. Shareholders will be diluted, but by a small margin (22 million SBC vs. 106 million FCF).

Wingstop is by no means a cheap stock. The company dropped more than 40% from its all-time highs and still trades at a 63 forward P/E. I’m not a fan of betting on companies to maintain their high multiples, and I would definitely not bet on Wingstop reverting back to its mean of 80 P/E or 12 P/S. Let’s assume a P/E of 40, which is reasonable if you assume that Wingstop gets closer to its goal of becoming a top 10 global restaurant brand, with better net income margins than companies like Chipotle or Texas Roadhouse, along with higher growth in revenue and EPS. If Wingstop achieves their EPS goal, the company would trade at $363 (assuming a 40 P/E). This represents a total return of 53% or just above an 11% CAGR.

Overall, Wingstop is a good-quality company in the fast-food restaurant business, and if their growth strategy, with the support of AI, plays out, I wouldn’t be surprised to see this stock trade significantly higher than a 40 P/E.

If you enjoy research like this, don’t forget to like and subscribe! Also, sharing this post on social media or with colleagues - along with a positive comment, helps the publication grow. Every share is greatly appreciated!